1. Breach of duty to maintain a net retention

a. General remarks

C1 A net retention aims to protect the reinsurer. A net retention ensures that the reinsured continues to have “skin in the game” – i.e. retains a stake or share in the risk – when managing underlying insurance contracts and handling claims (Schwepcke & Vetter 453; Schwepcke no 54; Meyenburg & Stahl 112, 113; Echarti & Labes no 54). In addition, a net retention is a relevant risk factor and provides a measure of the reinsured’s confidence in the underlying risk (Phoenix General Insurance of Greece v Halvanon Insurance [1985] 2 Lloyd’s Rep 599). Accordingly, a breach of a net retention obligation (i.e. where part or all of the net retention is ceded to another reinsurer) is detrimental to the reinsurer. Nevertheless, it is difficult to measure the reinsurer’s detriment resulting from the breach. Normally, the reinsurer does not suffer any quantifiable monetary damages from the breach of the duty to maintain net retention. However, the breach of the duty to maintain a net retention increases the moral hazard risk in relation to the reinsured.

C2 Article 6.2.2 provides for default rules on the legal consequences if the reinsured breaches an agreed duty to maintain a net retention. The default rule applies when the contract is silent on the consequences of a breach of the net retention agreement. Article 6.2.2 provides for remedies that respect both parties’ interests and strive to reflect in monetary terms the retention position immediately prior to the breach. Article 6.2.2 achieves that by considering the extent of the reduced net retention and the corresponding potential increase in moral hazard, while ensuring that the resulting legal consequences remain reasonable.

C3 The Principles take a balanced, non-punitive approach to the remedies for the breach of net retention agreement. This is because by reinsuring a part of the risk that should have been retained with another reinsurer, the reinsured will be paying additional premium reflective of the moral hazard and reducing its overall profits.

C4 The consequences of a breach of the duty to maintain net retention differ depending on whether the contract of reinsurance is proportional (paragraph (1)(a)) or non-proportional (paragraph (1)(b)). This distinction is based on the different characteristics of proportional and non-proportional reinsurance that have an impact on the manner in which a net retention operates. In proportional reinsurance, the reinsured and the reinsurer participate in the reinsured risk proportionally and share the gross premium in the same proportion. Proportional reinsurance is commonly used to cover an open portfolio managed by the reinsured over a longer period. In contrast to non-proportional reinsurance, the reinsured and the reinsurer share the underlying risk regardless of the number or amount of specific losses incurred (Liebwein 182). Therefore, the legal consequences set out in subparagraph (a) do not relate to specific losses but instead prescribe a reduction in the reinsured risk, accompanied by a recalculation of the commission in good faith. The commission is subject to recalculation as it is the true cost of the reinsurance coverage. In contrast, the premium is proportional to the reinsurer’s risk participation, and it is calculated under the underlying insurance contracts. Therefore, it is not subject to recalculation in case of a breach of the net retention agreement. In non-proportional reinsurance, the reinsurer provides coverage for specified losses in excess of a defined retention up to an agreed limit. It is often used to reduce claim peaks for rare but possible events. For that reason, the consequences of a breach of the duty to maintain net retention described in subparagraph (b) attach to one (aggregated or non-aggregated) loss event only.

C5 A reduction of an agreed net retention entitles the reinsurer to the remedies set out in paragraph (1). There is no materiality threshold that must be exceeded. The remedies do not apply automatically upon a breach of the duty to maintain net retention. The reinsurer may elect a remedy or elect not to use the remedy to which it is entitled and instead affirm the contract on the basis of the reduced net retention. Depending on the circumstances of the breach (e.g. the breach does not substantially affect the arrangements between the parties or is not harmful to the reinsurer) and/or the reinsurance arrangements and/or the relationship between the parties, the reinsurer may want to refrain altogether from applying the remedies available or, in the case of proportional reinsurance, the reinsurer may want to apply only one of the two remedies available. If the reinsurer decides to apply the remedies, they are effective from the time of the breach.

C6 The contracting parties are free to forgo the remedies provided for in paragraph (1) and/or agree different remedies at any time at or after the formation of the contract of reinsurance. This may be desirable where alternative remedies are aligned more closely to the specific type of reinsurance or the individual interests of the parties. For instance, contracting parties may prefer a subsequent premium or commission adjustment without any other changes in case of a long-term business relationship.

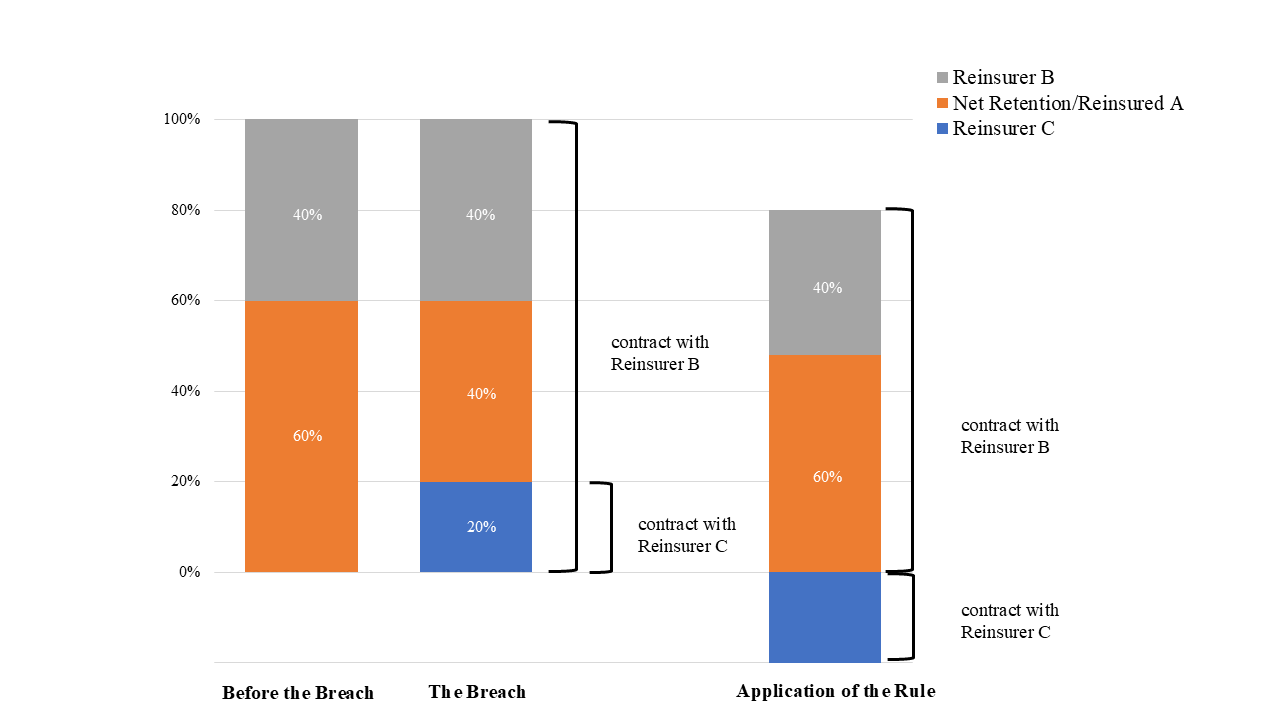

b. Proportional reinsurance

C7 The remedy prescribed in subparagraph (a) aims at restoring the retained part of the risk originally agreed upon between the parties. The amount of reinsured risk is reduced by the exact percentage the reinsured transferred in breach of the net retention agreement to a third party. The ratio between the originally agreed percentage of net retention and the percentage of net retention after the breach is immaterial. This can be demonstrated by way of example in Fig. 2 below. The bar “Before the Breach” represents the originally agreed net retention arrangement: the reinsured retains 60 percent of the reinsured risk for its own account without any reinsurance (net retention), while the reinsurer assumes responsibility for the remaining 40 percent of the reinsured risk. The bar “The Breach” illustrates the change in the portion of the reinsured risk retained by the reinsured as net retention in the event of a breach of the net retention agreement, i.e. the reinsured cedes a portion of the net retention (20 percent of the reinsured risk) to a third-party reinsurer. As a result, the reinsured’s net retention decreases to 40 percent of the reinsured risk, while the reinsurer’s share in the reinsured risk (i.e. 40 percent) and other contractual terms remain unchanged. The bar “Application of the Rule” demonstrates the implementation of the remedy prescribed in subparagraph (a). To restore the retained portion of the reinsured risk as originally agreed upon by the parties, the amount of risk reinsured under the contract of reinsurance is reduced by the exact percentage (i.e. 20 percent) that the reinsured wrongfully transferred to a third-party reinsurer in breach of the net retention agreement. As a result of this remedy, the originally agreed net retention agreement (i.e. 60 percent) and the proportions of the risk sharing between the parties (60 percent retained by the reinsured and 40 percent assumed by the reinsurer) now apply to 80 percent, rather than 100 percent, of the reinsured risk.

Figure 2: Remedy for breach of an agreement on net retention in proportional reinsurance

C8 Once the transferred portion of the net retention has been subtracted from the originally reinsured risk, the recalculated reinsured risk will be divided between the parties as originally agreed upon. The originally agreed shares remain unchanged (see Fig. 2 presented in the Comment above).

C9 In addition to reducing the reinsured risk, the reinsurer may recalculate the commission taking into account both risk- and market-related relevant factors. Under subparagraph (a), the reinsurer is permitted to adjust the commission. Both the decision as to whether to recalculate the commission and the commission adjustment itself, must be made in good faith in accordance with Article 2.1.2. Risk-related factors are a reduction of the reinsured risk and any changes to the reinsured risk occurring since contract formation. Relevant market-related factors are any changes in the market environment since contract formation. Given the overriding good faith requirement, the application of subparagraph (a) should always result in a remedy that is commercially reasonable. For example, a recalculation of the commission would be necessary if the ratio between the remaining reinsured risk and the commission as originally charged were to become grossly imbalanced. By contrast, a recalculation of commission may not be justified where market conditions have changed such that the reinsured would profit from a reduced commission as a result of its breach of the duty to maintain net retention. For example, in a situation with a declining market, subparagraph (a) does not prompt the reinsurer to adjust the commission to the new market environment.

Illustrations

I1. Reinsured A places a 40 percent quota share treaty with Reinsurer B for its fire insurance business in South Africa. Reinsured A retains 60 percent for its own account and unreinsured (net retention). The maximum sum insured is USD 20 million. During the first year, losses of USD 10 million falling under the coverage of the contract of reinsurance occur. Reinsurer B is liable for USD 4 million. Reinsured A bears USD 6 million net retention for its own account.

I2. Same facts as in the previous Illustration, but instead of keeping 60 percent net retention for its own account, Reinsured A breaches the net retention agreement and cedes 20 percent retention to Reinsurer C. Reinsured A reduces its net retention by 20 percent. Under subparagraph (a), 20 percentage points are subtracted from the reinsured risk. The remaining reinsured risk between Reinsured A and Reinsurer B is USD 16 million (80 percent of USD 20 million). In this situation, the reduction of the reinsured risk does not affect Reinsured A’s claim against Reinsurer B. Reinsured A bears USD 6 million retention (60 percent of USD 10 million), USD 2 million (20 percent of USD 10 million) of which it transfers to Reinsurer C. USD 4 million (40 percent of USD 10 million) are covered by Reinsurer B. Reinsurer B may, in good faith, recalculate the commission taking into account risk-related as well as relevant market-related factors.

I3. Same facts as in Illustration 1 but due to a heat wave, the number of wildfire losses in South Africa increases massively and during the first year of the term of the contract of reinsurance, losses of USD 40 million falling under the coverage of the contract of reinsurance occur. Reinsurer B covers USD 8 million (40 percent of the maximum sum insured, USD 20 million). Reinsured A bears USD 32 million (60 percent of USD 20 million + USD 20 million exceeding the maximum sum insured) for its own account. However, if Reinsured A breaches its duty to maintain net retention and cedes 20 percent to Reinsured C (as in Illustration 2), under subparagraph (a), the reinsured risk of USD 20 million is reduced by 20 percentage points to USD 16 million. Applying the remedies in subparagraph (a), Reinsurer B covers only USD 6.4 million (40 percent of USD 16 million) and Reinsured A bears USD 33.6 million (60 percent of 16 million + USD 24 million exceeding the adjusted maximum sum insured). The agreement between Reinsured A and Reinsurer C is not affected. Reinsured A can claim USD 4 million (20 percent of USD 20 million) from Reinsurer C. In addition, Reinsurer B may recalculate the commission in good faith taking into account risk-related as well as relevant market-related factors.

C10 As noted in Comment 6, the parties are free to forgo the remedies provided for in subparagraph (a) and/or agree on different remedies for a breach of the duty to maintain a net retention. In long-term contractual relationships, the parties may prefer to agree on a more lenient remedy that adjusts the reinsured losses, leaving the reinsured risk and commission unchanged (comparable to the remedy granted under subparagraph (b) in relation to non-proportional reinsurance).

c. Non-proportional reinsurance

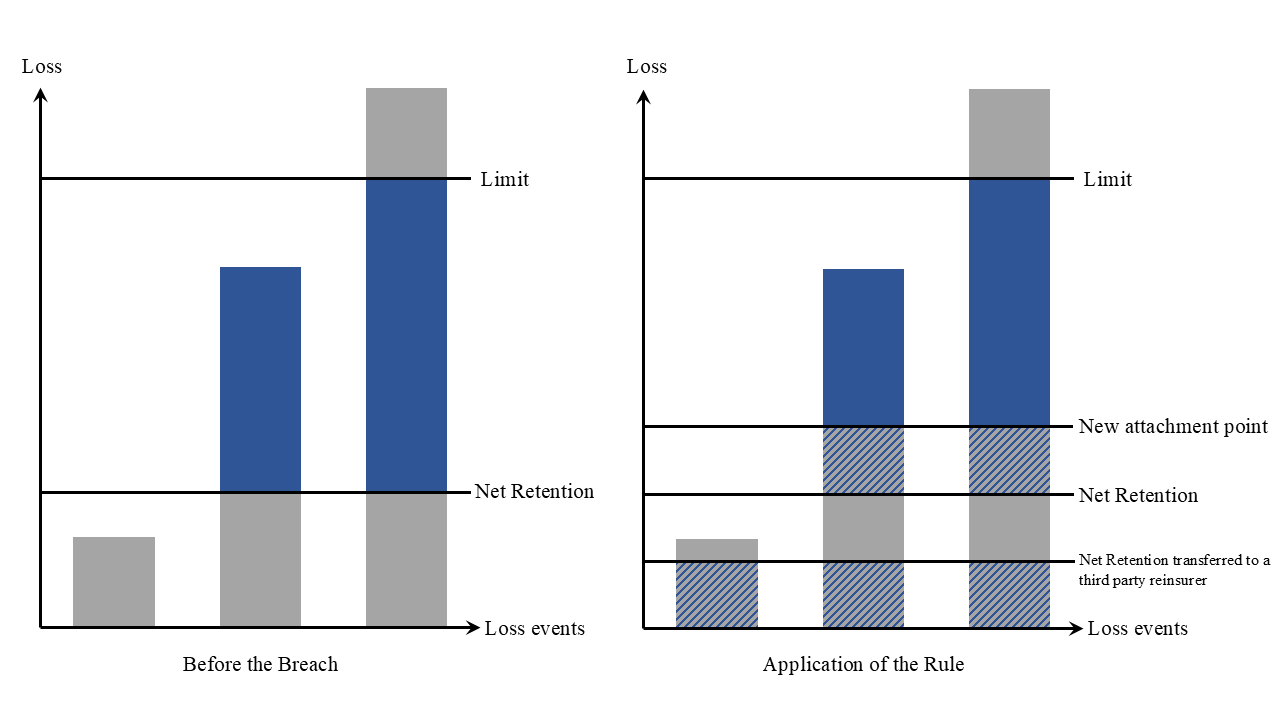

C11 In non-proportional reinsurance, the net retention per one (aggregated or non-aggregated) loss is commonly defined as an absolute amount. In such case, the attachment point describes the upper limit of the retention. If the reinsured reduces the agreed absolute amount of the net retention and a loss occurs, the reinsurer may increase the attachment point by the amount by which the net retention was reduced. As a result, the reinsurance cover will not be triggered until the increased attachment point is reached. There is no proportional reduction of the reinsured loss.

C12 While the attachment point of the reinsurance protection is increased, the limit – i.e. the ceiling of the reinsurer’s liability – does not change. The reasons for this are that the reinsured must not benefit from the breach of the duty to maintain net retention by effectively obtaining extended coverage, and any higher layers in a reinsurance program must not be disturbed (see Comment 19).

C13 The net retention is kept as the first unreinsured layer of a reinsurance program in order to fulfil its intended purpose. For example, if a reinsured buys excess of loss reinsurance for USD 100 million in excess of USD 20 million and agrees to keep all USD 20 million as net retention, it cannot transfer its net retention to another reinsurer and add a new unreinsured layer over USD 20 million on top of the programme for its own account.

Illustration

I4. Graphical illustration of the operation of subparagraph (b) based on excess of loss reinsurance:

Figure 3: Remedy for breach of an agreement on net retention in non-proportional reinsurance

I5. Reinsurer B issues excess of loss reinsurance for USD 50 million in excess of USD 20 million. Reinsurer B and Reinsured A agree on a net retention of USD 20 million. In breach of the net retention obligation, Reinsured A reinsures USD 20 million with Reinsurer C. A loss of USD 30 million occurs. The attachment point of the reinsurance protection was originally at USD 20 million. Due to the breach of the duty and in order to maintain the net retention by Reinsured A, the attachment point increases by USD 20 million and moves up to USD 40 million. The loss of USD 30 million does not exceed USD 40 million and therefore does not trigger reinsurance cover under the contract with Reinsurer B. Reinsured A suffers a total loss of USD 30 million and bears 10 million for its own account. USD 20 million are covered under the contract of reinsurance with Reinsurer C.

I6. Reinsured A and Reinsurer B agree on an excess of loss reinsurance for USD 50 million in excess of USD 20 million. They agree on a USD 20 million net retention. In breach of the duty to maintain the net retention, Reinsured A transfers the first layer of USD 20 million to Reinsurer C. A loss of USD 70 million occurs. If Reinsured A had not breached the net retention agreement, Reinsurer B would have to cover USD 50 million. As a result of the breach of the duty to maintain the net retention, the attachment point of the reinsurance cover increases by USD 20 million to USD 40 million. The limit of USD 50 million remains. Overall, Reinsurer B covers USD 30 million, the third-party reinsurer covers USD 20 million and Reinsured A bears USD 20 million.

2. Relationship between the remedies under Article 6.2.2 and Article 3.1

C14 With the exception of Article 3.1(1)(a), the general remedies set out in Article 3.1 may be applied in addition to the remedies set out in Article 6.2.2(1). Article 6.2.2 does not operate as lex specialis in relation to Article 3.1(1)(b) and Article 3.1(2).

C15 A reinsurer cannot claim performance under Article 3.1(1)(a) because performance would interfere with separate and independent contracts of reinsurance. Nevertheless, the parties may at any time agree that the reinsurer will waive its right under Article 6.2.2 if the reinsured succeeds in cancelling the additional reinsurance coverage obtained in breach of the duty to maintain the net retention.

C16 In addition to the remedies provided for in Article 6.2.2(1), a reinsurer can claim damages under Article 3.1(1)(b). Damages suffered by a reinsurer as a result of a breach of the duty to maintain the net retention may include, for example, investigation costs. However, the reinsurer cannot avoid the contract and therefore cannot treat it as never having existed. It may not reach an equivalent result by claiming restitution in kind as granted under e.g. German law (Naturalrestitution) (see BGH V ZR 29/96 NJW 1998, 302).

C17 The reinsurer may terminate the contract in accordance with Article 3.1(2) if it cannot reasonably be expected to uphold the contract. The primary remedy to restore the originally agreed risk participation and theoretically increased moral hazard is covered by Article 6.2.2(1). Only in exceptional circumstances would a breach of the duty to maintain the net retention satisfy the requirements of Article 3.1(2), thereby giving the reinsurer the additional option to terminate the contract. Relevant factors would include the extent of the reduction of the agreed net retention, whether the reinsured still retains any part of the reinsured risk for its own account without any insurance cover, and whether the reinsured’s actions have increased moral hazard.

3. Operation of the rule in special cases

C18 The rules on retention were designed with straightforward reinsurance arrangements in mind. In cases where the contracts of reinsurance are more complex, the operation of the rule may need to be adjusted to individual circumstances. The following comments outline examples of special cases where the operation of the rule may appear problematic. In these cases, the parties should carefully consider whether the rule is appropriate or needs to be tailored to suit their specific circumstances.

C19 In layered programmes, the rule is applicable to the first and subsequent layers. Each layer has to be treated separately. If the Principles are the chosen law of one specific contract of a layered programme, the rule applies only to this contract regardless of whether the Principles are also chosen law in one or multiple other contracts of reinsurance of the same layered programme. The consequences set out in Article 6.2.2 do not have to be adjusted for contracts of reinsurance that are part of a layered programme because other layers are not affected. For example, in non-proportional reinsurance, the attachment point changes but the limits of each layer remain unchanged. If a reinsurer, in any layer, wants to keep the reinsured engaged in the risk, reinsurer and reinsured have to agree on a retention individually in their own layer.

C20 Transfer of a part or all of the net retention to another company from a group of companies to which the reinsured belongs (intragroup retrocession) is considered a breach of the duty to maintain the net retention. The parties may, however, agree that the intragroup retrocession will not constitute a breach of the agreement on net retention.

C21 There may be specific contractual arrangements to which the remedies provided for in paragraph (1) are not applicable. This is especially the case where proportional and non-proportional products are combined. Therefore, tailored remedies suitable to the circumstances should be agreed. The agreement on tailored remedies should nevertheless respect both parties’ interests and restore as far as possible the parties to the position they were in immediately prior to the breach of the agreement on net retention, guided by the general principle of proportional remedies.

C22 As explained in Comment 1 above and Comment 2 to Article 6.2.1, the net retention agreement serves to mitigate moral hazard. In particular, the aim behind the consequences for a breach of the duty to maintain net retention (Article 6.2.2) is to prevent an increase in moral hazard which may result from the breach of the net retention. Since there are cases where the moral hazard is diminished, the operation of the rule and the consequences of the breach of the duty to maintain the net retention should be verified and tailored to the special circumstances at hand, if necessary. Legacy business (in particular, the case of Lloyd’s market) and life reinsurance treaties under which no new risks are accepted are examples of special cases in which the parties may want to deviate from the rule and negotiate terms that would reflect the specific circumstances of the contractual arrangements.